CROWD

IN THIS YEAR, THE RESULTS OF CROWDSOURCING ANALYSES ARE PART OF THE TOTAL SCORE FOR THE FIRST TIME. 268,000 USERS IN THE UK HAVE CONTRIBUTED TO THE DATA GATHERING THAT TOOK PLACE FROM AUGUST TO OCTOBER, 2018.

While the drivetests and walktests determine the peak performance of the examined networks, crowdsourcing can add important dimensions such as time, geography or variety in devices and tariff plans – if done in the right way. For the collection of crowd data, P3 has integrated a background diagnosis processes into more than 800 diverse Android apps. If one of these applications is installed on the enduser’s phone and the user authorizes the background analysis, data collection takes place 24/7, 365 days a year. Reports are generated for every quarter of an hour and sent daily to P3‘s cloud servers. Such reports generate just a small number of bytes per message and do not include any personal user data. A more detailed description of our crowdsourcing methodology can be found in the methodology section. Based on the total population count of 66 million people, one of 246 inhabitants of the United Kingdom has contributed to the gathering of 2.99 billion single samples of crowd data. The considered test area represents 99 per cent of the built-up area of the UK.

EE LEADS THE FIELD REGARDING CROWDSOURCED COVERAGE

All UK operators show a good score level for their voice and data coverage. In the Quality of Voice Coverage, EE, Vodafone and O2 are more or less on a par, In the Quality of Data Coverage (which considers 3G plus 4G), Three takes a narrow lead. The Quality of 4G Coverage leaves some room for improvement. In particular, Three falls behind competition regarding 4G coverage for both footprint (Test Area Coverage) as well as the likelihood of being able to actually use 4G service (4G Quality of Coverage). Looking at all three coverage KPIs combined, EE leads the field.

ASSESSING COVERAGE

BASED ON CROWD KPIS

Our coverage metrics correspond to the results of our drivetests and walktests. However, it is no surprise that the crowdsourced KPIs for voice, data and 4G coverage deviate to a certain extent from the population coverage values stated by most operators: P3’s gathering of crowd data reflects where people actually are and move as opposed to their places of residence and working. Furthermore, our crowdsourcing also comprises indoor or other disadvantageous reception situations, while operators commonly base their claims on outdoor reception only.

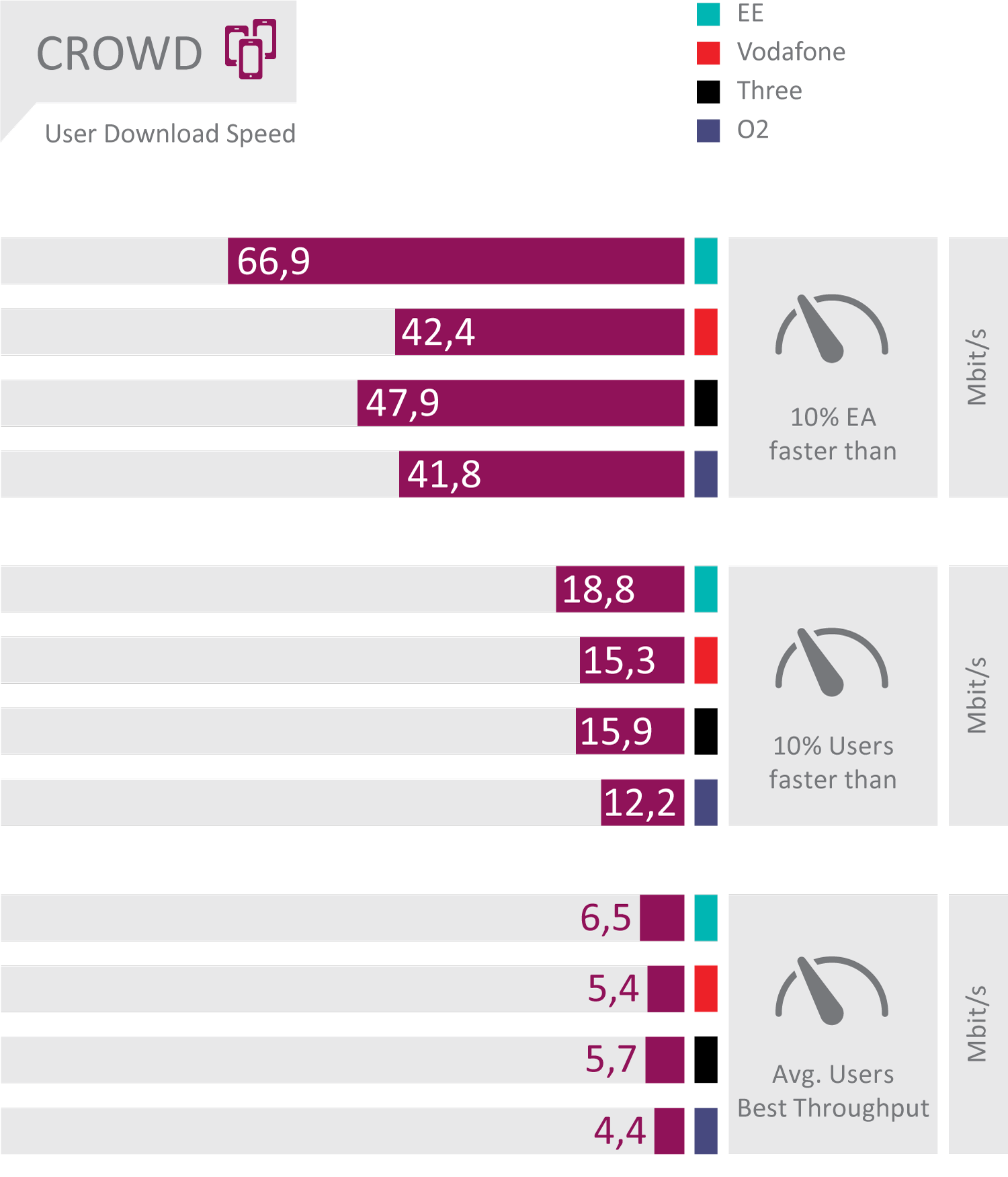

EE SHOWS FASTEST DOWNLOAD SPEEDS IN TOP 10 PER CENT OF EVALUATION AREAS

In the assessment of download speeds available to the users, EE shows the best results for the top 10 per cent of Evaluation Areas. In this category as well as in the assessment of average download speeds, Three scores ahead of Vodafone and O2. Generally, it must be taken into consideration that a part of the actual user base probably experiences data speed limitations caused by their mobile tariffs.

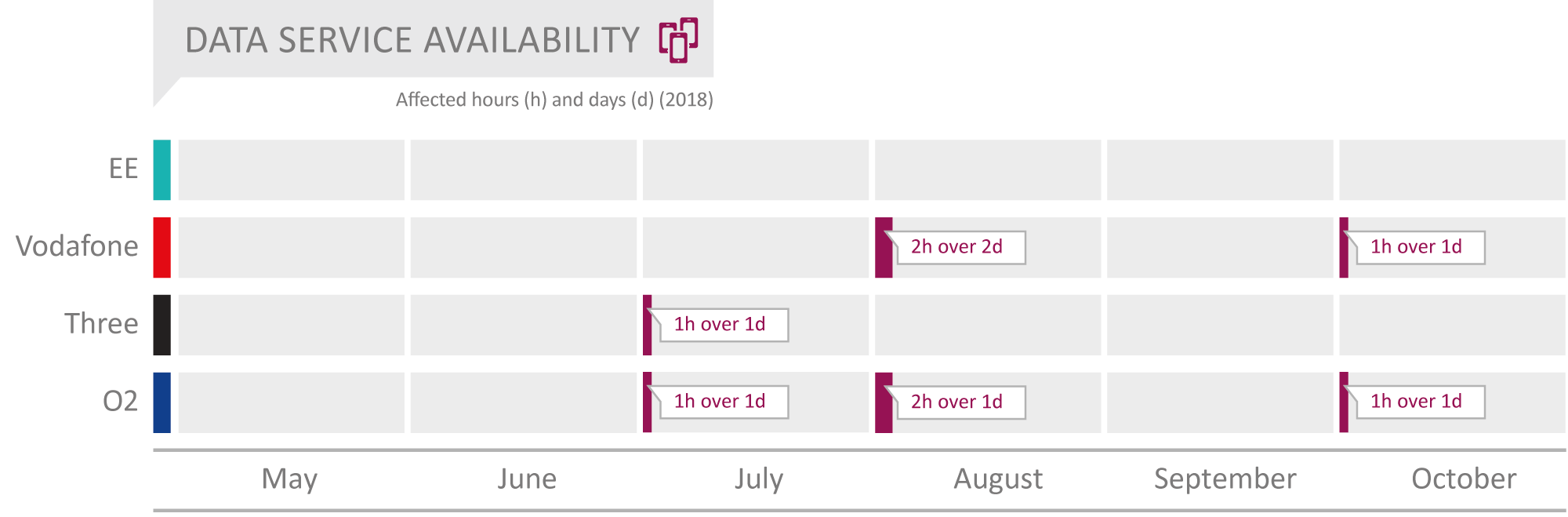

EE DID NOT SHOW ANY SERVICE DEGRADATIONS FROM MAY 2018 TO OCTOBER 2018

Other than the rest of the crowd KPIs, our examination of Data Service Availability covers six months (May to October 2018). EE scores best in this consideration again, showing no service degradations in the observation period. Three ranks second with a one hour outage in July. Vodafone suffered two outages – one in August and one in October. O2 ranks last in this category, because our examination revealed three outages in July, August and October.

“EE TAKES THE LEAD IN CROWDSOURCED QUALITY AND OVERALL IN ALL CROWDSOURCED CATEGORIES. ”

“CROWD RESULTS AT A GLANCE

EE takes the lead in the crowdsourced quality, and overall in all crowdsourced categories. It offers the highest data rates and did not suffer any service degradations from May to October 2018. O2 ranks second in all crowdsourced categories, and Vodafone third, only one point behind O2. Three follows at some distance on the last rank in this discipline.”

LONDON

TRADITIONALLY, P3 AND CONNECT TAKE A CLOSER LOOK AT THE UK‘S CAPITAL TO SEE HOW THE OPERATORS COVER THIS LIVELY CENTRE OF BUSINESS, POLITICS AND SOCIETY.

EE LEADS IN LONDON TOO, VODAFONE RANKS SECOND AND SCORES SLIGHTLY BETTER THAN IN THE WHOLE UK

The overall winner in London is EE – much the same as in the nationwide assessment. In the capital, this operator achieves somewhat higher scores than in the overall results. Interestingly, its drivetest results are slightly lower than in the whole country assessement. In the walktests, EE scores slightly better in the capital or, in the case of the voice measurements, it achieves the same score of a full 100 per cent. The crowd results in London are also a little higher than the nationwide score. EE achieves the same 100 per cent score as all over the UK. Vodafone ranks second in London as well, but achieves better scores in London for the voice drivetest as well as for the data drive and walktest results compared to its nationwide score. Also, its crowd score for London is considerably higher than all over the country. The scores of the voice walktests conducted in London fall a little behind the nationwide average.

O2 OVERTAKES THREE IN LONDON, BOTH ARE CLOSE TOGETHER

In contrast to the nationwide ranking, O2 achieves the third rank in London and overall scores two points ahead of Three. In comparison to the whole UK, O2 in London shows particularly better results in the voice drive and walktests and in the crowd score, but falls behind in the data drivetests and walktests. Notably, Three‘s results in London are behind the nationwide average with the only exception of the crowd score.

“LONDON RESULTS AT A GLANCE

As in the nationalwide results, EE is also the winner in London. It achieves better or the same results than in the whole UK, particularly in the walktests. The drivetests conducted in London show weaker results – which is also true for Vodafone and Three, as well as O2’s data performance. Still, Vodafone reaches a strong second rank in the capital. O2 overtakes Three in London, with both contenders scoring close together.”

As interesting as the focus on the densely populated London area is, the inhabitants of other large UK cities and the capitals of the other countries besides England have their own perspective on network performance and availability. In order to also provide valuable insights for their inhabitants, we have additionally analysed the performances of the four operators in nine large UK cities – specifically Belfast, Birmingham, Bristol, Cardiff, Edinburgh, Glasgow, Liverpool, Manchester and Sheffield.

SAME RANKING AS NATIONWIDE IN BELFAST, LIVERPOOL AND SHEFFIELD:

EE LEADS, VODAFONE SECOND

The same ranking as in the nationwide assessment can be seen in Belfast, Liverpool and Sheffield. Here, EE is the clear leader, followed by Vodafone. Three ranks third, and O2 last. While in Belfast and Sheffield this ranking is quite distinct, all four contenders score quite close together in Liverpool. Here, even Three and O2 show comparably strong results.

VODAFONE OVERTAKES EE IN BIRMINGHAM, BRISTOL, CARDIFF, GLASGOW

AND MANCHESTER

In Birmingham, Bristol, Cardiff and Manchester, the fight for the top rank is close, but Vodafone manages to overtake a still strong EE in these cities by a close margin. In Birmingham, Vodafone is stronger in voice than EE, in Cardiff and Glasgow stronger in data. In Bristol and Manchester, Vodafone outranks the nationwide winner in both disciplines. Their crowd scores are in most cases close together. In Birmingham and Manchester, O2 shows stronger results than Three. In Bristol, Cardiff and Glasgow it is just the other way round.

EE LEADS IN EDINBURGH, BUT O2 RANKS SECOND, THREE THIRD

AND VODAFONE LAST

In Edinburgh, it is no surprise that EE ranked first, but the order of the other contenders is interesting. In the capital of Scotland, O2 shows a particularly strong performance and ranks second due to especially good data results. The crowd scores confirm the leading position of EE, the other three operators rank close together in this perspective. Three even manages to overtake Vodafone which can be explained by Vodafone‘s eye-catchingly weak data results in this city.