VOICE

MANY CUSTOMERS USE VOICE SERVICES LESS INTENSELY THAN DATA. HOWEVER, WHEN ACTUALLY TAKING OR PLACING A PHONE CALL, THEY EXPECT RELIABLE CONNECTIONS. HOW DO THE AUSTRALIAN NETWORKS FULLFIL THESE EXPECTATIONS?

All three Australian operators support Voice over LTE (VoLTE). VoLTE transmits voice calls as data packets over a 4G connection. This way, the otherwise necessary “circuit-switched fallback“, which forces smartphones to switch back to 3G in order to take or place a phone call, can be avoided. Also, VoLTE supports better audio codecs providing operators with the opportunity to deliver higher speech quality to their customers. For the voice rating, each drivetest car and each walktest team carried one Samsung Galaxy S8 smartphone per operator. The phones in the cars always called a counterpart in one of the other cars. The phones carried by the walktest teams called a stationary counterpart. The connected testing equipment registered success ratios, call setup times and speech quality. In order to simulate normal smartphone usage, data transfers took place in the background of the test calls.

“TELSTRA IS THE WINNER FOR VOICE, WITH OPTUS A CLOSE SECOND. VODAFONE FOLLOWS AT A DISTANCE.”

TELSTRA LEADS IN THE DRIVETESTS CONDUCTED IN BIG CITIES

In the drivetests conducted in Adelaide, Brisbane, Canberra, Melbourne, Perth, Sydney, Toowoomba and Wollongong, Telstra takes the overall lead. This operator scores two percentage points ahead of its competitors mainly due to higher call success ratios. But Optus and Vodafone also show very robust results in this category.

OPTUS IS AHEAD IN THE WALKTESTS

Brisbane, Canberra, Melbourne and Sydney were additionally visited by P3’s walktest teams. In this category, Optus is ahead of the competition by two percentage points. This lead is earned by high call success ratios and also very fast call setup times. But again, the two other contenders also achieve convincing results.

OPTUS SHOWS ALSO BEST RESULTS IN SMALLER TOWNS

As in the big city walktests, Optus is also ahead in the smaller Australian towns that were part of our test routes. But in this case, the lead is only by a narrow margin – or one percentage point respectively. It is earned by the best call success ratios and the fastestcall setup times. But as in the twocategories before, Optus and Vodafone also show robust results.

OPTUS AHEAD OF TELSTRA ON THE ROADS BY A NARROW MARGIN, VODAFONE FOLLOWS AT A DISTINCT DISTANCE

Optus also achieves the best voice results on the connecting roads that were covered by our test vehicles. However, this time, the competition takes place at a significantly lower level. Optus gains 59 per cent of the possible points in this category, Telstra follows with 57 percent and Vodafone at a distinct distance with only 30 percent. Call success ratios dropping to about 88 per cent and lower reveal that permanent voice connectivity is not at all a given on Australian roads.

“VOICE RESULTS AT A GLANCE

In the overall assessment, Telstra leads by one point in the voice category, which it earned in the big city drivetests. Optus is almost on a par and achieved slightly better results in the big city walktests, in smaller towns and – at a lower performance level – on the connecting roads. Vodafone can almost keep up in the cities and towns but clearly loses ground on the roads.”

DATA

WITH THE VOLUME OF TRANSMITTED DATA PERMANENTLY GROWING, DATA CONNECTIVITY CONSTANTLY BECOMES MORE IMPORTANT. WHICH AUSTRALIAN OPERATOR MANAGES BEST TO MEET THE INCREASING DEMAND?

Data connectivity is the most prestigious discipline in our benchmark and also in the operators’ marketing. All three Australian networks claim to cover a large part of the population with LTE services – the claimed percentages range in the high nineties. Telstra, Optus and Vodafone are continuing to spend billions of dollars on upgrading and expanding their networks to meet the increasing demand. According to the Australian Bureau of Statistics, the total amount of data downloaded by mobile devices grew by 28 per cent between June 2017 and June 2018, reaching 123,147 terabytes at this latest point of the research period. Australian operators reacted by introducing unlimited data plans in 2018 and also increasing the uncapped volumens included in their lower priced tariffs.

P3’S SCORING REWARDS HIGH PERFORMANCE AS WELL AS THE NETWORKS’ AVAILABILITY AND STABILITY

In order to assess the performance and reliability of data connections, each of our four drivetest cars and also the walktest team carried one Samsung Galaxy S8 per operator. Supporting the LTE category 16, these smartphones were able to benefit from the so-called carrier aggregation – the combined use of up to three LTE carrier frequencies which can theoretically transmit up to 1 Gbps. (Please see explanation about walktest results in the Telstra andVodafone networks in section “Walktests in Big Cities“ below.)

In the operators’ marketing, this functionality bears names such as “4GX”, “4G Plus” or “LTE-Advanced”. P3‘s testing considers such fast throughputs as well as the networks‘ availability and stability. In order to assess typical performance as well as peak speeds, we consider two values: the minimum data rate that is available in 90 per cent of the cases, and additionally the peak data rate that is surpassed in 10 per cent of the cases. Web page and file downloads or uploads reward fast speeds, while determination of successratios and assessing YouTube playouts concentrate on reliability aspects. As YouTube streams videos at adaptive bitrates, the average value of the received video resolution is another important performance indicator.

“OPTUS LEADS IN THE DATA CATEGORY, ESPECIALLY DUE TO STRONG RESULTS IN SMALLER TOWNS AND ON THE ROADS.”

TELSTRA AND OPTUS ALMOST ON A PAR IN BIG CITY DRIVETESTS

In the scoring of their performance determined during the drivetests conducted in big Australian cities, both Telstra and Optus achieve 95 per cent of the available points in this discipline. The success ratios are all in all on the same level, while Optus achieves slightly higher maximum download speeds and Telstra scores a little higher in the average download rates. With 92 per cent of the achievable points, Vodafone ranks third but can mostly keep up with its two slightly stronger competitors.

WALKTESTS IN BIG CITIES

As in the voice discipline before, Optus also leads the field in the data measurements taken during the walktests in the big cities. Telstra falls behind by 4 percentage points (Optus: 97 per cent,Telstra: 94 per cent), and Vodafonemore distinctly by achieving 81 per cent of the possible points in this category. Part of an explanation for these results is that Optus particularly stands out with the best web browsing experience among all Australian operators.

During the walk test phase of our benchmark in Australia a firmware issue was experienced on the smartphones resulting in Telstra and Vodafone being unable to take advantage of carrier aggregation (CA). Therefore the walktest results are lower than anticipated, but reliability results were not affected. Due to the high performance levels of both these networks approximately two points were lost which did not impact the overall ranking.

(In order to avoid possible misunderstandings we have made minor revisions and clarifications compared to the original version of this website. The topics in question result from the firmware issue on the smartphones used for the walktests in the Telstra and Vodafone networks which are described above.)

OPTUS LEADS THE FIELD IN THE DATA TESTS CONDUCTED IN SMALLER TOWNS

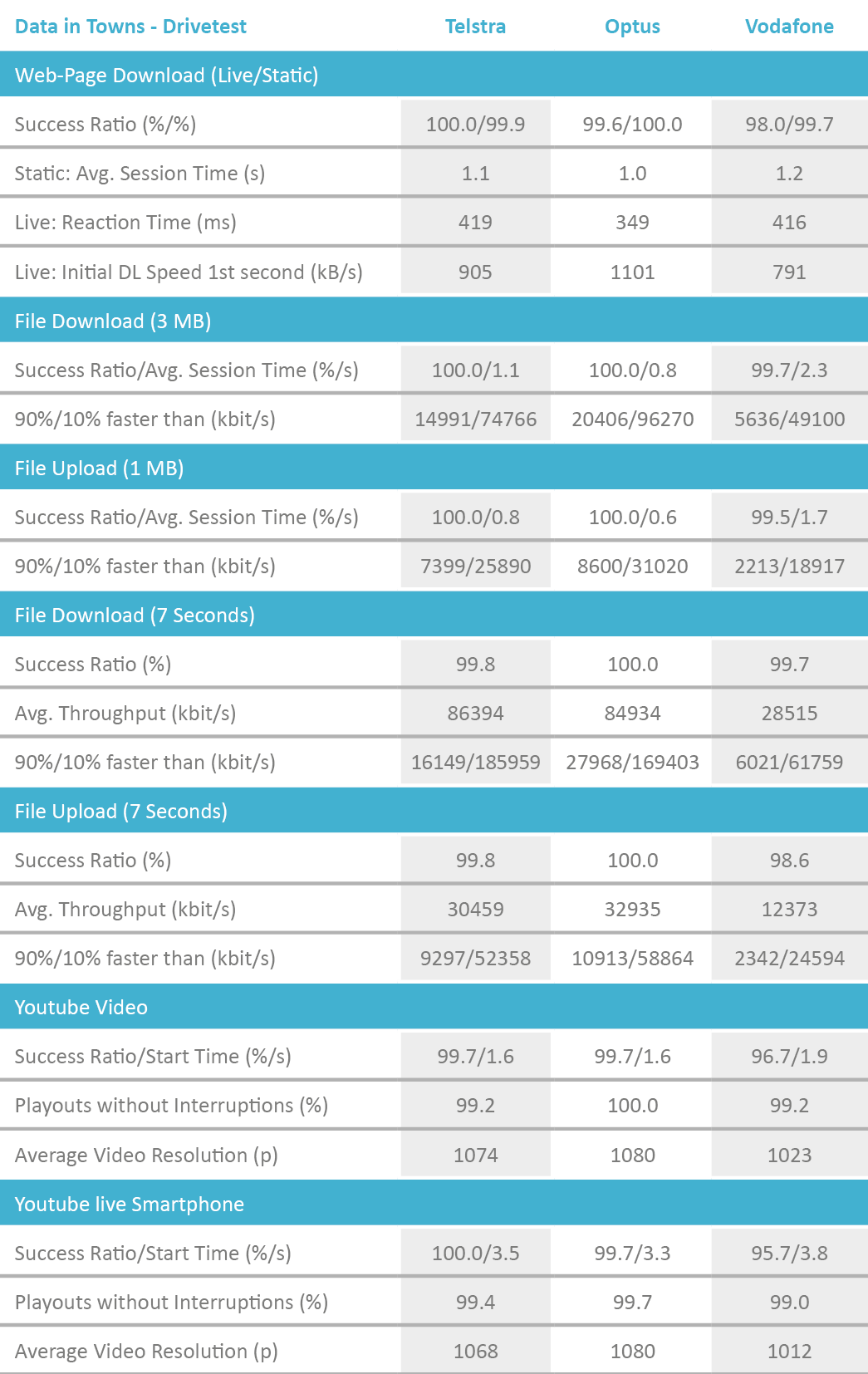

This picture now almost becomes familiar: As in the voice discipline, Optus also achieves the best score in the data drivetests conducted in smaller Australian towns. This is valid for practically all data services. Telstra follows at a small distance, and Vodafone at a more pronounced one.

ACCEPTABLE RESULTS FOR OPTUS AND TELSTRA ON THE ROADS

Overall, Optus achieved 70 per cent of the available points for the data drivetests on the connecting roads. Telstra follows with 67 per cent. Both results are acceptable but not great. Vodafone shows the same weaknesses as in the voice category before and only achieves 30 per cent of the possible points. While Optus and Telstra offer success ratios of about 90 per cent andabove, Vodafone drops to success ratios of 80 per cent and below.

“DATA RESULTS AT A GLANCE

In the drivetests conducted in the big cities, Telstra and Optus are almost on a par, whereas Optus shows better performance for all data services in the smaller towns and on the roads. While Vodafone can mostly keep up with the other two contenders in the city drivetests, it falls behind in the walktests, in smaller towns and with a significant gap towards the competion on the connecting roads.”