Download English PDF version of the test here

Download Spanish PDF version of the test here

The 2019 Mobile Network Test in SPAIN

For the fifth time, the benchmarking expert umlaut and connect magazine have conducted their authoritative benchmark of the Spanish mobile networks. Once again, we have enhanced the underlying methodology.

The detailed findings show a mix of familiar results and some surprises. The winner holds its solid lead for the fifth time in a row, while the second place contender has improved considerably. But not all operators managed to improve their scores.

RESULTS IN A NUTSHELL

Vodafone wins the umlaut connect Mobile Benchmark Spain for the fifth time in a row. Orange holds its second place position and shows impressive score improvements over last year‘s results. Movistar ranks third and Yoigo fourth, both with overall “good“ results.

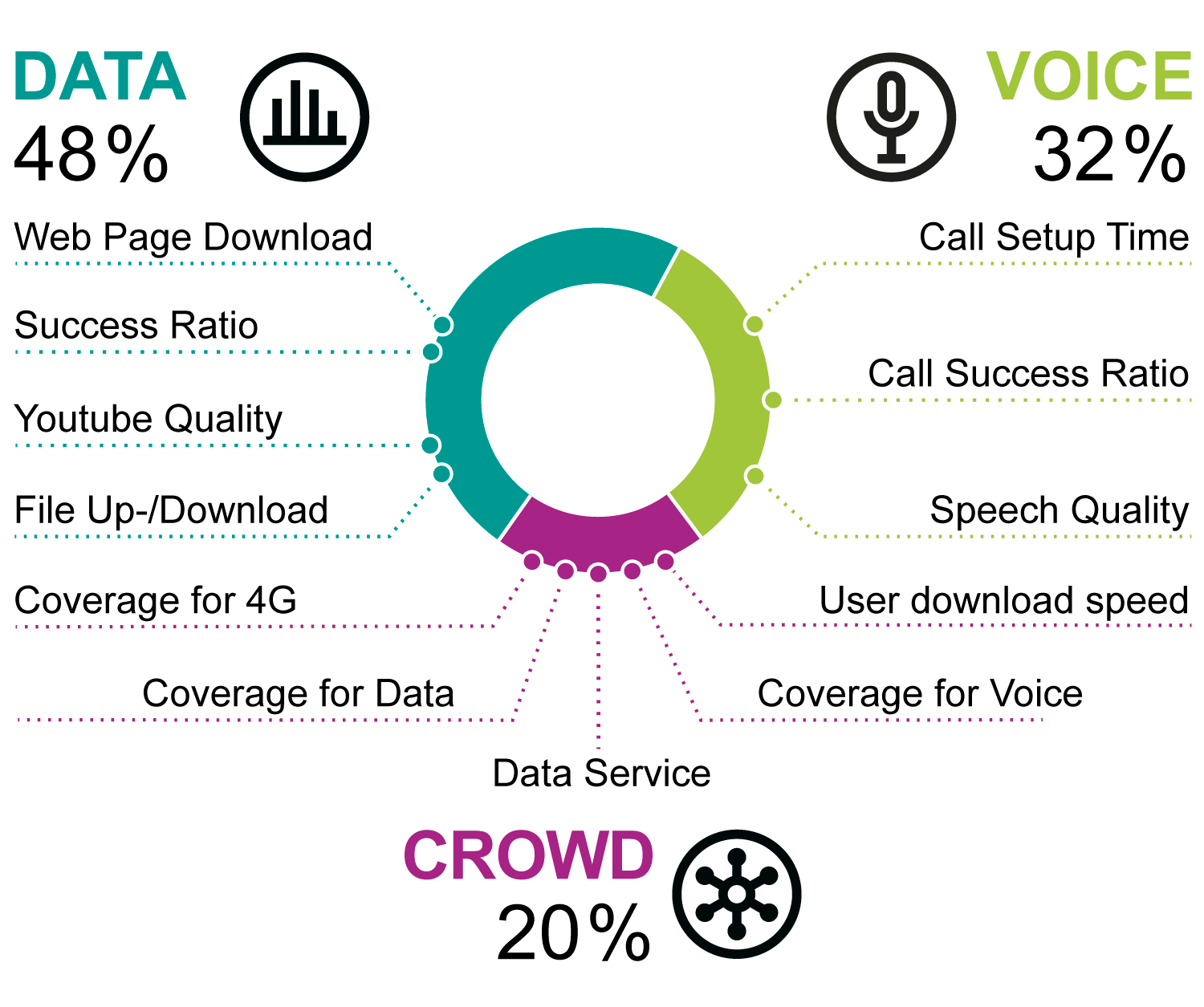

umlaut‘s network benchmarks are widely accepted as the de-facto industry standard and for being highly objective. The carefully designed methodology of our 2019 benchmark in Spain represents umlaut‘s holistic approach to network benchmarking. It combines drivetests and walktests for executing detailed voice and data measurements under controlled circumstances with a sophisticated crowdsourcing approach. This provides profound insights into the overall coverage of voice, data and 4G services, real-world User Download Speeds and Data Service Availability.

The drivetests and walktests allow for evaluating the maximum of the networks‘ capabilities. Crowdsourcing unveils the service quality and performance actually experienced by real users. We have thoroughly weighed these components in order to give a realistic and authoritative assessment of the rated networks‘ true potential and performance.

VODAFONE IS THE OVERALL WINNER, ORANGE SHOWS BIGGEST SCORE IMPROVEMENTS

As in the four previous years, the overall winner is Vodafone. Orange scores second and shows the biggest improvements over the score achieved in last year‘s benchmark. Both Vodafone and Orange have earned the grade “very good“.

Movistar ranks third and Yoigo fourth as in last year‘s evaluation. When comparing the overall scores with those of our 2018 benchmark in Spain, both Movistar and Yoigo lose some points. But both still show strong performances, achieving the grade “good“.

In the crowdsourcing category, Movistar has taken over the lead from Orange this year, scoring two points ahead of the also strong contenders Orange and Vodafone. Particularly pleasant are the results of our Data Service Availability assessment which did not identify any degradations in any Spanish network throughout the whole 24-week evaluation period spanning from mid-April to end of September 2019.

As a case study, we also conducted 5G measurements in die Vodafone network in Madrid for the first time. The results emphasize the performance advantages of 5G, showing very

short latencies and impressively high data rates..

Vodafone and Orange improve their scores over our 2018 benchmark – Orange even with a plus of 18 points. Movistar and Yoigo lost a couple of points but both achieve good results.

SPAINS operators

The three largest Spanish mobile network operators are in constant competition for subscribers and market share. Also, all four Spanish operators have consistantly increased their LTE coverage and speeds – and Vodafone has already deployed first 5G installations in 15 cities.

Movistar is the brand name the Spanish telecommunications company Telefónica uses for the mobile network in its home market. Telefónica S.A. itself is one of the largest telco companies in the world. The operator is active in 17 countries with a total of 121,800 employees and achieved worldwide revenues of over €48 billion in its fiscal year 2018.

While the company introduced the Movistar brand in Latin American countries in 2005, it has been active in Spain since the launch of GSM services back in 1995. Today, Movistar is the largest mobile operator in Spain with about 17.6 million subscribers, which equates to a market share of over 30 per cent.

It offers GSM service at 900 and 1800 MHz, UMTS/ 3G at 900 and 2100 MHz and LTE at 800, 1800 and 2600 MHz. Since the end of 2014, Movistar has supported 4G+ carrier aggregation with maximum speeds reaching up to 500 Mbps today. The operator claims to provide 4G coverage of more than 96 per cent of the Spanish population and has also recently introduced VoLTE.

Orange España is the brand name of France Telecom‘s mobile network in Spain. It has been operating under this name since 2006. Previously, the network was known as “Amena“ – this brand name lives on in Orange Spain‘s portfolio as a low-cost offer that is only available via the internet. Also, its network serves a number of mobile virtual network operators such as MasMovil, Carrefour Móvil and others

With approx.15.9 million customers, Orange is the second largest Spanish mobile operator with a market share of about 26 per cent. In the fiscal year 2018, Orange Spain achieved a revenue of €5.3 billion which contributed 15 per cent to the total revenue of the Orange Group.

Orange Spain has deployed 2G networks at 900 and 1800 MHz, 3G networks at 900 and 2100 MHz and 4G at 800, 1800 and 2600 MHz. The operator claims that its 4G network reaches more than 97 per cent of the Spanish population. Also, Orange was the first Spanish operator to offer VoLTE to its 4G customers.

Vodafone España has been present on the Spanish mobile communications market since the year 2000. Then, the British Vodafone Group acquired Airtel Móviles which had operated in Spain since 1994. In Spain, Vodafone reports 13.5 million mobile customers, adding up to a market share of about 24 per cent. This makes Vodafone the third largest operator in the country following at close distance behind its competitor Orange. In the fiscal year 2018/2019, Vodafone Spain achieved revenues of €4.3 billion which contributes about nine per cent to the whole Vodafone Group‘s financial results.

Vodafone‘s mobile network in Spain offers GSM service at 900 and 1800 MHz, UMTS/3G at 900 and 2100 MHz and LTE at 800, 1800, 2100 and 2600 MHz. The Vodafone 4G network in Spain supports LTE carrier aggregation (“4G+“) with maximum speeds of 500 Mbps as well as VoLTE. Vodafone España claims to offer the best LTE coverage in Spain, reaching approx. 98 per cent of the Spanish population, and has now launched Spain‘s first 5G network cells in 15 cities.

Yoigo was the latest mobile operator to enter the Spanish market. Founded in 2000 under the name Xfera, the company started its actual operation in 2006, offering only a UMTS/3G network at 2100 MHz. At this time, the Swedish telecommunications company TeliaSonera acquired the majority of shares and rebranded the network as “Yoigo“. In June 2016, the former MVNO (mobile virtual network operator) Másmóvil bought the company. For its fiscal year 2018, Másmóvil reported revenues in Spain of €1.5 billion.

Yoigo had a national roaming agreement with Movistar until the end of 2016. Since January 2017, Yoigo customers freely roam in the 2G and 3G networks of Orange at locations without Yoigo coverage. Yoigo claims a mobile customer base of 6.8 million mobile subscribers, which equals a market share of approx. 13 per cent. Today, Yoigo operates 3G at 2100 MHz as well as 4G at 1800 MHz. Thanks to its roaming agreements, the operator claims an LTE coverage of approx. 98 per cent of the population.

A close look at Spain’s networks

umlaut‘s network benchmarks are widely accepted as a completely objective authority. In 2019, we conduct the umlaut connect Mobile Benchmark Spain for the fifth time, further enhancing its methodology.

umlaut, based in Aachen, Germany, is a world leader in mobile network testing. The company was formerly known as P3 communications and changed its name in fall 2019 in the course of restructuring and refocusing its activities. umlaut has over 4,300 employees, distributed over about 50 locations all over the world, and a turnover of more than 400 million Euros.

umlaut is partnering with the international telecommunications magazine connect, which has more than 25 years of editorial expertise and is one of the leading test authorities in Europe for telecommunications products and services. Together,

umlaut and connect have been conducting the most important network benchmark test in Germany for more than 15 years, extending it to other European countries since 2009. As the de-facto industry standard, umlaut‘s benchmarking methodology focuses on customer-perceived network quality.

The 2019 umlaut connect Mobile Benchmark Spain consists of

drivetests and walktests conducted in September and October 2019. Four drive test cars together covered 11,570 kilometres. The test areas account for 11.7 million people, or roughly 25.2 per cent of the total population of Spain. In addition, the results of extensive crowdsourcing analyses considering 24 weeks from April to September 2019 are included in the score.

Hakan Ekmen, CEO umlaut

“Congratulations to Vodafone, leading in Spain for the fifth time in a row. Orange shows the biggest score improvements this year, ranking second overall.

With our new brand umlaut we are also adding something on top: We have measured 5G for the first time in Spain. The results are quite impressive with throughputs above 500 Mbit/s in the downlink and 70 Mbit/s in the uplink. This I would call real early innovation.“