Download English PDF version of the test here

The 2022 fixed-line broadband benchmark

in the netherlands

Having tested the Dutch mobile networks various times, the benchmarking expert umlaut and connect magazine now also take a closer look at the fixed-line broadband connections in the Netherlands.

The fixed-line evaluation is based on a sophisticated crowdsourcing methodology, which provides informative insights about the actual data rates and latencies which arrive at the users‘ devices.

KEY FINDINGS

For the first time in the Netherlands, umlaut and connect have used umlaut‘s sophisticated crowdsourcing approach to offer a comprehensive look at the user experience of Dutch fixed-line customers. The results reveal three very good fixed-line offerings and one follower achieving the overall grade “good“.

The network benchmarks conducted by umlaut, part of Accenture, and connect are widely accepted as the de-facto industry standard and for being highly objective. With a further refinement of the crowdsourcing methodology already known from umlaut‘s accredited mobile network

benchmarks, it became also possible to analyze the main performance KPIs of fixed-line services. Thus, umlaut and connect have taken a closer look at the fixed-line networks in the Netherlands.

The 2022 umlaut connect Fixed-Line Broadband Benchmark for the Netherlands is based on 3,048,708 samples which have been gathered in the 24 weeks between mid-July and end of December, 2021, from 53,000 fixed lines in the Netherlands. Its carefully designed methodology provides profound insights into the actual user experience of Dutch fixed-line customers. Using a complex set of rules and comprehensive checks, umlaut has ensured the validity of its evaluations.

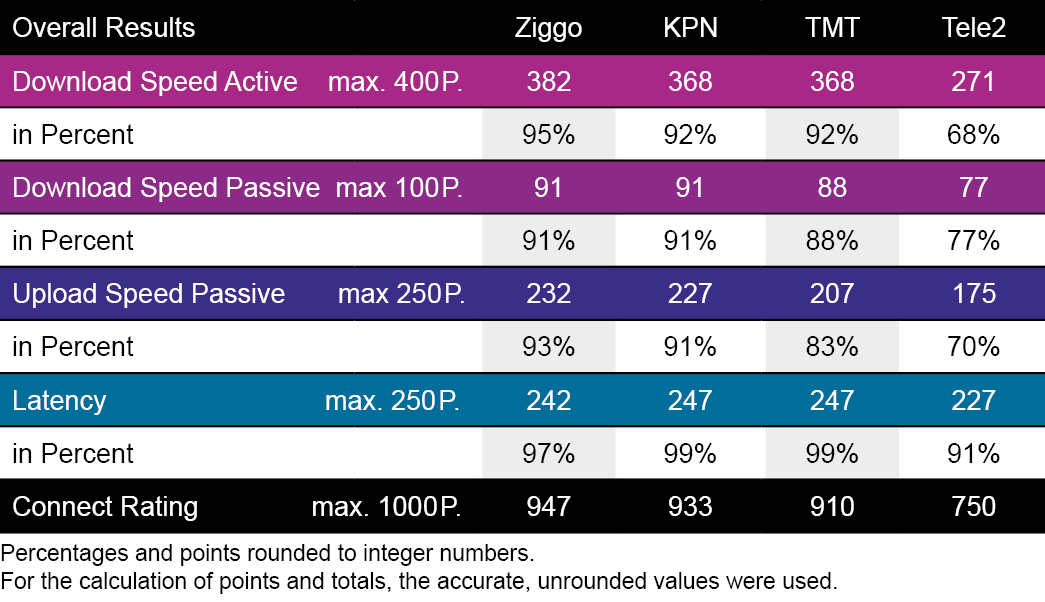

ZIGGO IS THE OVERALL WINNER. KPN RANKS SECOND

AND T-MOBILE THIRD – ALL THREE WITH THE GRADE

VERY GOOD. TELE2 FOLLOWS ON A GOOD FOURTH RANK.

With very strong results overall and particularly in the categories of the active download tests and the passive upload observations, Ziggo is the overall winner with the grade “very good“.

KPN achieves a very good second rank, showing particularly strong results in the active and passive download assessments as well as in the observed latencies. Above that, KPN achieves particularly high data rates on its fibre lines – showing the effects of recent investments in this area. Furthermore, KPN is the local champion in the province of Limburg, also with the grade “outstanding“.

T-Mobile (in our tables “TMT“), rated as the operator of the fixed network of the same name, achieves also a very good overall result. The operator is also local champion in the province of Overijssel, where it even receives the grade “outstanding“.

Although being part of T-Mobile now, Tele2 is evaluated separately based on the operator designation of its fixed-line connections. Overall, Tele2 ranks fourth, but still achieves a good result. It even manages to pass its parent company in Gelderland, Noord-Holland and Utrecht.

Ziggo is the overall winner with the grade

“very good“. In the local analyses of larger Dutch provinces, Ziggo even receives the rarely awarded grade“outstanding“ in Gelderland, Noord-Holland and Utrecht.

THE DUTCH FIXED-LINE operators

Although there is a number of locally active smaller fixed-line providers, in order to ensure the statistical relevance of this broadband benchmark’s results, umlaut and connect concentrate on the large, nationwide fixed-line network operators in the Netherlands. Behind the four largest networks are now three operators, because the formerly individual Tele2 network is now part of T-Mobile Netherlands.

The Dutch subsidiary of the international Vodafone Group acquired the operator Libertel in 2003, forming Vodafone Netherlands. In 2016, it merged with the cable and fibre operator Ziggo. Today, 50 per cent of the joint company Vodafone-Ziggo is owned by the Vodafone Group and another 50 per cent by Liberty Global.

In its Q3 2021 report, Vodafone-Ziggo specifies 3.7 million fixed (broadband, video and telephony) subscribers. 1.5 million of these households are designated as “converged households“ – meaning that they use both the mobile and the fixed-line network of the operator. Based on this number, Vodafone-Ziggo has currently the biggest fixed-line market share in the Netherlands.

Also according to Vodafone-Ziggo‘s latest publications, the company‘s fixed-line network reaches approx. 7.3 million “homes passed“ – the theoretical number of households to which the operator could provide its fixed-line services.

The Koninklijke PTT Nederland N.V. emerged from the privatisation of the formerly state-owned PTT in 1998. For the third quarter of 2021, the company reported to serve a total of 1,5 million fixed-mobile households and a total of 1.3 million fixed-only households. These numbers are amended by about 334,000 broadband lines supplied to business customers, resulting in approx. 3.1 million fixed-line customers altogether. Approx. 2.2 million of them are also interactive TV customers. Based on current customer numbers, KPN is the second largest fixed-line operator in the Netherlands.

According to the figures published in KPN’s annual reports, a large proportion of the fixed-line households are connected via fibre. This corresponds with the company’s own disclosure that it has recently surpassed

3 millions “homes passed” by its FTTH network and a total of approx. 8.9 million homes and offices passed by its fixed line network on the whole.

Also, in early 2021, KPN and the Dutch pension fund APG announced the start of their joint fibre company “Glaspoort”, which is scheduled to invest more than €1 billion in the construction of approximately one million fibre connections in villages, small residential areas and business parks.

In 2000, Deutsche Telekom bought a minority of the Dutch mobile network operator Ben, which was later extended to a 100 per cent acquisition. In 2003, Ben was renamed

T-Mobile Netherlands, with the brand “Ben“ becoming a “no-frills“ offer within its portfolio. In 2007, T-Mobile NL additionally acquired Orange. The acquisition of Thuis in 2016 marked T-Mobile NL‘s entry into the fixed broadband market.

At the end of 2018, the company completed its acquisition of the smallest Dutch operator, Tele2, which brought both its own mobile as well as its own fixed-line network to the merger. By now, also the technical infrastructure of the formerly separate carriers has been merged, with Telekom holding 75 per cent and Tele2 holding 25 per cent of the assets.

The company also announced a strategic partnership with Open Dutch Fiber in 2021.

In the fall of 2021, T-Mobile Netherlands was acquired by the private equity investors Apax and Warburg Pincus. At this time, the company reported a total of 6.9 million customers, of which approx. 700,000 were fixed-line broadband customers.

As many users currently still use their existing contracts, the fixed-line networks of T-Mobile NL and Tele2 appear separately in umlaut‘s crowd assessment.

A CLOSE LOOK AT THE DUTCH fixed-line NETWORKS

The network benchmarks conducted by umlaut and connect are widely accepted as a completely objective authority. In 2022, we present the umlaut connect Fixed-Line Broadband Benchmark in the Netherlands for the first time.

umlaut, headquartered in Aachen, Germany, is a world leader in mobile network testing. The company was formerly known as P3 communications, changed its name in autumn 2019, and has become a part of Accenture in 2021. umlaut has over 4,300 employees, distributed in over 50 locations all around the world, with a turnover of more than 400 million Euros. umlaut is partnering with the international telecommunications magazine connect, which has 28 years of editorial expertise and is one of the leading test authorities in Europe for telecommunication products and services. Together, we – umlaut and connect – have been conducting the most important mobile network benchmark test in Germany for almost 20 years, extending it to other European countries since 2009.

As the de-facto industry standard, the methodology of these benchmarks focuses on customer-perceived network quality. In addtion to measurements performed in drive and walktests, they also include refined crowdsourcing analyses.

By carefully filtering and validating these crowdsourced data (also see Methodology on page 10 for details), umlaut can use its sophisticated crowdsourcing platform also for evaluating fixed-line connections. These evaluations investigate the results from active and passive speed measurements as well as the determined latencies of the network connections. The 2022 umlaut connect Fixed-Line Broadband Benchmark in the Netherlands is based on this approach. It takes into account 3,048,708 samples which have been gathered in the 24 weeks between mid-July and end of December, 2021, from 53,000 fixed lines in the Netherlands.

Hakan Ekmen,

CEO Telecommunication at umlaut

Congratulations to Vodafone-Ziggo for winning the 2022 umlaut connect Fixed-Line Broadband Benchmark in the Netherlands! Our assessment shows that great efforts in enhanced the fixed-line network expansion are worthwhile in order to offer customers reliability, high data rates and low latencies. The results achieved by KPN and T-Mobile are also very convincing and absolutely deserve the awarded grade “very good“. Tele2 shows some opportunity for improvement, but still reaches a good result. Overall, Dutch customers can be quite pleased with the user experience of their fixed-line connections.“